Many people who receive disability payments also rely on food assistance programs, often referred to as food stamps or SNAP (Supplemental Nutrition Assistance Program). This can lead to questions about how these two forms of aid interact. The primary concern for many is whether the money they receive for food is deducted directly from their disability checks. This essay will explore the relationship between disability payments and food stamps, clarifying how these programs work together to support individuals and families in need.

Does Food Stamps Directly Deduct From Disability?

No, food stamps do not come directly out of disability payments. The two programs are managed separately. Disability payments, like those from Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), are intended to help cover living expenses because of a disability that prevents a person from working. Food stamps, on the other hand, are designed specifically to help people afford groceries. The amount of food stamps a person receives is determined by their income, assets, and the number of people in their household. Disability payments are considered income, so they can affect the amount of food stamps a person is eligible for, but the food stamps themselves are not subtracted directly from the disability check.

How Disability Income Affects Food Stamp Eligibility

When someone applies for food stamps, the local or state agency looks at their income to figure out how much help they can get. Disability income, like SSDI or SSI, is counted as income. This means a higher disability payment can result in a lower amount of food stamps, or even make a person ineligible for food stamps, because they are deemed to have enough money to buy food on their own. It is important to understand that this income is reported and tracked by both programs to see that they are used and allocated correctly.

The specific rules for income limits vary by state and depend on the size of the household. Here are a few things that are generally considered when calculating income for food stamp eligibility:

- Wages from employment

- Self-employment earnings

- Unemployment benefits

- Social Security benefits, including SSDI and SSI

Sometimes, certain expenses can be deducted from a person’s income before their food stamp eligibility is calculated. For example, medical expenses for the disabled or elderly, childcare costs, and certain housing costs might be deductible, potentially increasing the amount of food stamps a person can receive.

For instance, imagine two people, both with disabilities and a single household:

- Person A receives $1,000 a month in disability payments.

- Person B receives $1,500 a month in disability payments.

The amount of food stamps they are eligible for may vary, with Person B potentially receiving less or none at all due to the higher income.

The Application Process for Food Stamps When Receiving Disability

Applying for food stamps when you already receive disability benefits involves a few key steps. You will typically apply through your local or state social services agency or online. They will need to know your income, which includes your disability payments. This means you will need to provide proof of your disability income, like an award letter or a bank statement showing the monthly payments.

The application form will also ask for information about your household size, your assets (like savings accounts), and your housing costs. Be prepared to provide documentation for all these things. The agency will review your application and verify the information you provide, which may involve checking with the Social Security Administration or other sources.

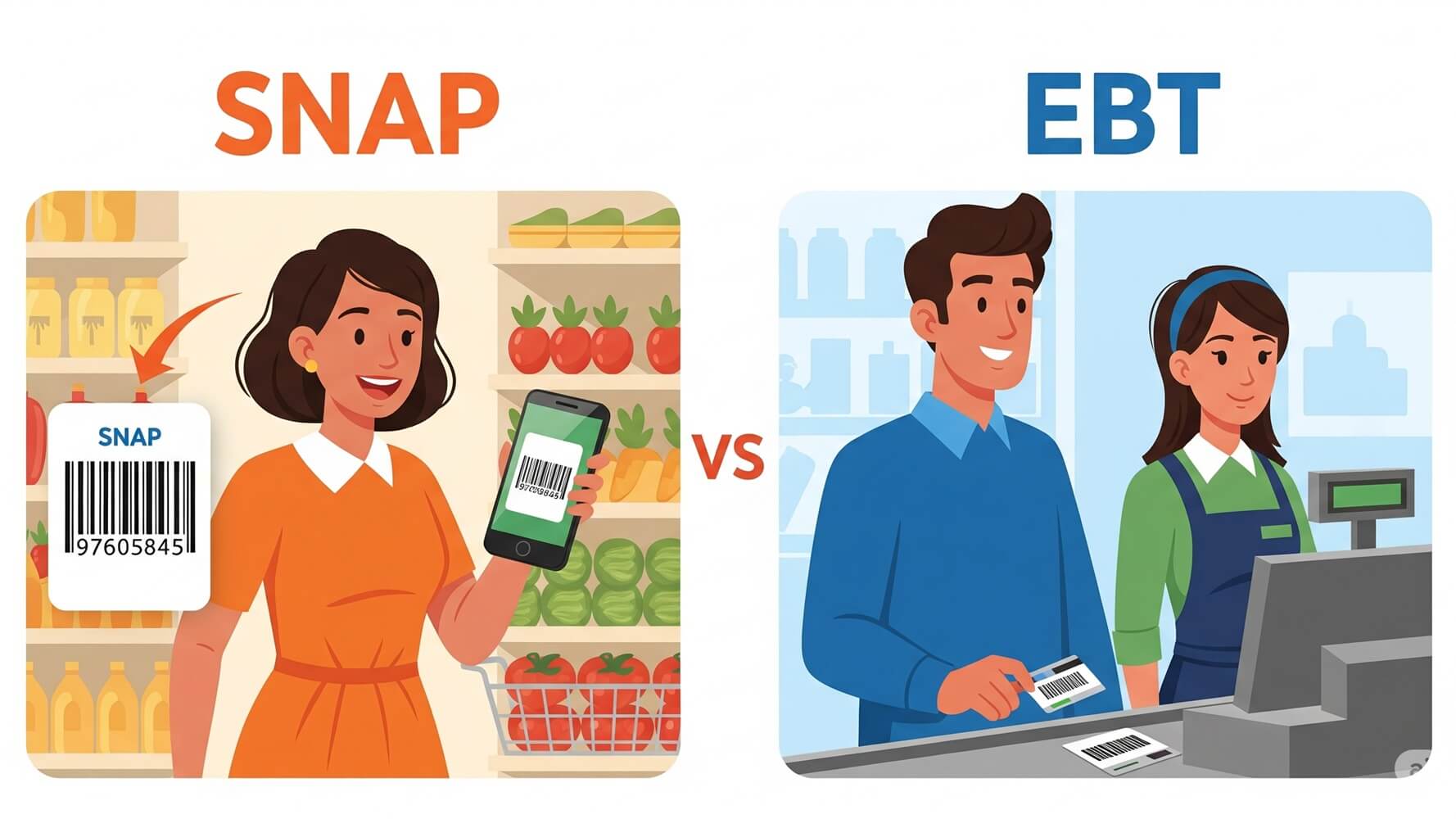

After reviewing your application, the agency will determine your eligibility and benefit amount. If you are approved, you will receive an EBT (Electronic Benefit Transfer) card, which works like a debit card and can be used to purchase groceries at authorized retailers. Remember to keep your card secure.

Here’s a simplified overview of the application process:

- Gather Required Documents: Disability award letters, bank statements, proof of address, etc.

- Complete the Application: Online or in-person, providing accurate information.

- Submit Application: Follow the instructions provided by your local agency.

- Interview: Be prepared for a possible interview to verify the information.

- Approval/Denial: The agency will notify you of their decision.

- Receive Benefits: If approved, receive your EBT card and start using it.

Types of Disability Benefits and Their Impact on Food Stamps

Different types of disability benefits can have different effects on food stamp eligibility. Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are two of the most common. SSDI is for people who have worked and paid Social Security taxes, while SSI is for people with limited income and resources, regardless of their work history.

Since both SSDI and SSI are considered income, they both impact food stamp eligibility. SSI has stricter income limits, often making it more difficult for recipients to qualify for food stamps. The amount of SSI a person receives is lower than SSDI, which can impact how many food stamps a person will get.

Other types of disability benefits, like veterans’ disability compensation or state-funded disability programs, are also generally considered income for food stamp purposes. It’s important to report all income sources when applying for food stamps to avoid issues and ensure you are receiving the correct amount of benefits.

Here is a simplified comparison table:

| Disability Benefit | Source of Funds | Impact on Food Stamps |

|---|---|---|

| SSDI | Work history, paid taxes | Impacts eligibility and benefit amount |

| SSI | Limited income/resources | Impacts eligibility and benefit amount, stricter limits |

| Veterans’ Disability | Service-related injury | Impacts eligibility and benefit amount |

Changes in Disability Payments and Their Effect on Food Stamps

Changes in your disability payments can affect your food stamp benefits. If your disability payments increase, it’s likely that your food stamp benefits will decrease, or you may become ineligible. You are required to report any changes in your income to the food stamp agency to avoid potential issues.

Similarly, if your disability payments decrease, you may become eligible for more food stamps. It’s crucial to keep the food stamp agency updated on any income changes to ensure you are receiving the right amount of assistance. The agency will reassess your eligibility and benefits based on your new income.

Failure to report changes in income can lead to overpayment of benefits, which the agency will try to recover. It is vital to keep all documents related to both programs together and available for review. Reporting on time and keeping them informed is important.

Here is an example of how changes might affect food stamps:

- Scenario 1: Disability payments increase by $200.

- Outcome: Food stamp benefits might decrease, or be reduced to $0.

- Scenario 2: Disability payments decrease by $100.

- Outcome: Food stamp benefits might increase.

- Scenario 3: Disability payments remain the same.

- Outcome: Food stamp benefits may remain the same (depending on other factors).

What to Do if You Have Problems with Food Stamps or Disability

If you run into problems with your food stamps or disability benefits, there are steps you can take to resolve them. First, try to contact the agencies that manage the programs. For food stamps, contact your local or state social services agency. For disability, contact the Social Security Administration. Explain the situation and ask for clarification.

Keep records of all communications, including dates, times, and names of the people you spoke with. If you disagree with a decision made by either agency, you have the right to appeal. The appeal process will vary depending on the program, but it typically involves submitting a written request for reconsideration and providing any supporting documentation. Some appeals may involve a hearing.

You can also seek help from advocacy organizations or legal aid services. These organizations can provide guidance and support throughout the process, ensuring that your rights are protected. Remember, always be respectful and provide the agencies with as much information as possible.

Here are some resources to help:

- Local Social Services Agency: For food stamp issues.

- Social Security Administration: For disability issues.

- Legal Aid Services: Can provide free legal help.

- Advocacy Groups: Offer support and guidance on your rights.

Can You Get Both Food Stamps and Disability Simultaneously?

Yes, it is definitely possible to receive both food stamps and disability payments at the same time. In fact, many people with disabilities rely on both programs to make ends meet. The important thing to remember is that disability income is considered income when determining food stamp eligibility. This means that while you can get both, the amount of food stamps you receive might be affected by the amount of your disability payments.

Both programs serve different purposes: disability payments are for covering general living expenses due to a disability, and food stamps are specifically for buying food. They work together to provide a safety net for people who need extra help. The combination is not always ideal. However, it is a way to survive and ensure some food on the table.

Here’s a basic overview:

| Program | Purpose | Impact of Disability |

|---|---|---|

| Food Stamps (SNAP) | Food assistance | Disability income is considered for eligibility |

| Disability Payments (SSDI/SSI) | Living expenses due to disability | Does not affect food stamp amounts directly |

Remember, it’s important to report all income to the food stamp agency to ensure you get the correct amount of benefits. If you have any questions, contact your local agency. They can help you navigate the process and answer questions you may have.

Conclusion

In summary, while food stamps do not come directly out of disability payments, the amount you receive in disability benefits can influence your eligibility for food stamps. Disability income is considered when determining your food stamp amount. Both programs aim to support individuals and families in need, providing essential assistance to help with living expenses. By understanding how these programs work together, you can better manage your finances and access the support you need. Remember to report all income changes promptly and seek help from available resources if you face any challenges.